Explain Three Key Differences Between Index Funds and Mutual Funds.

Identify the type of function represented by fx 4 2x O A. 22 of 23 Vanguard balanced funds.

What Is An Index Fund Forbes Advisor

The withdrawal process of mutual funds is more straightforward for the short term processes whereas in the case of hedge funds the investment is locked for a specific time that is why withdrawals are not possible.

. Mutual funds on the other hand stick to the shallows where they can catch smaller but more reliable returns. Index fund performance is. In the open-ended mutual fund there is no fixed maturity period whereas there is a definite maturity period in the case of closed-ended funds.

ETFs can be sold short whereas mutual funds cannot and typically ETFs have lower expense fees. Mutual funds come with risk-free policies whereas hedge funds are hazardous to invest. As against this in the closed-ended scheme the stock market provides liquidity.

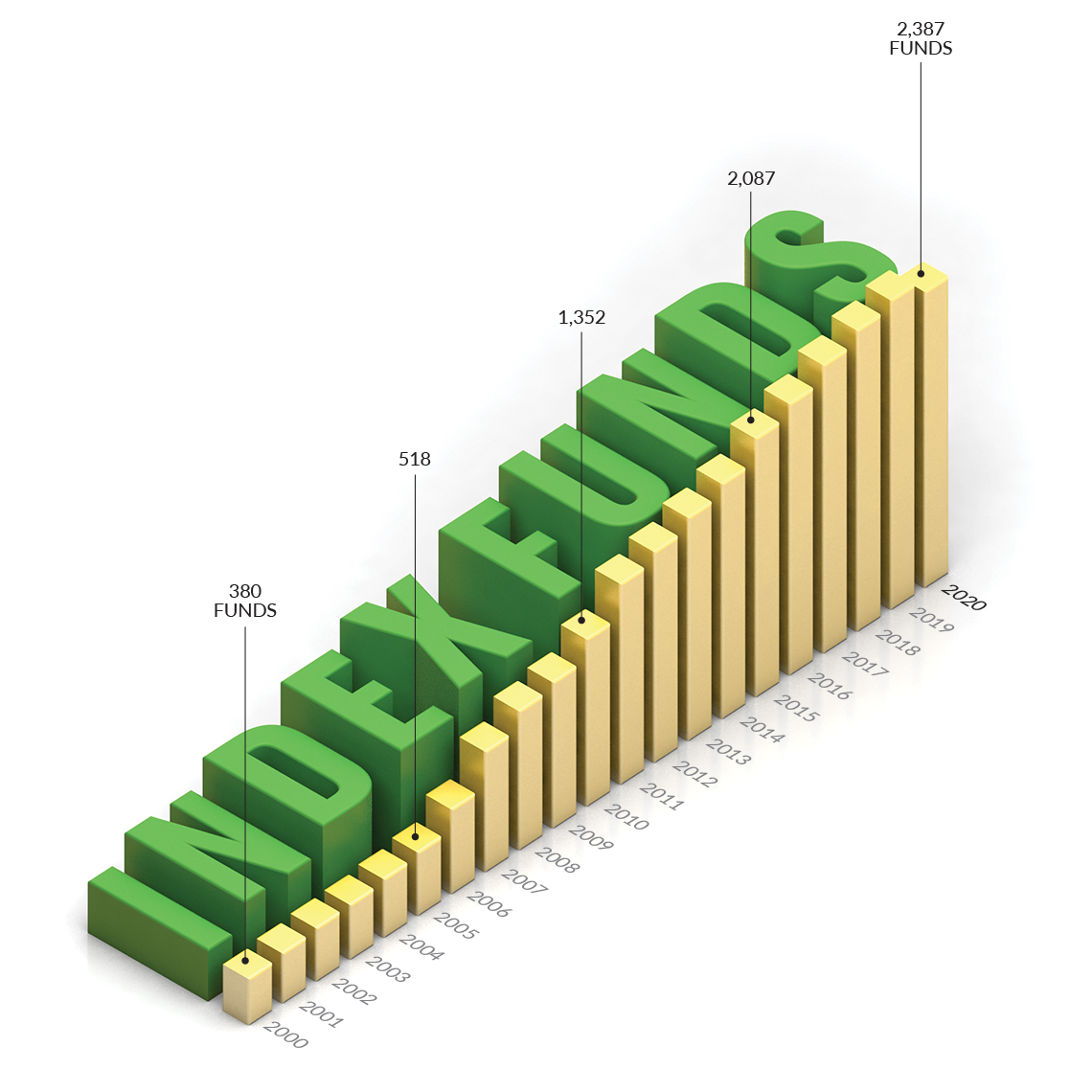

Mutual funds are collective investments schemes that gather and invest money from several investors in securities like stocks bonds money market instruments and commodities like precious metals while an index fund is a kind of mutual fund. Mutual funds trade directly on stock exchanges while exchange-traded funds are purchased from a financial broker. According to Vanguard in a study of index funds versus active funds for the 10 years ending June 30 2020 a total of 180 of 205 Vanguard funds outperformed their peer-group averages.

This is because there is no fund manager actively supervising the index fund. The other the mutual fund was designed to give investors a way to beat market averages. The performance of an index fund will track that.

Clearly something else is going. Its easy to get confused about what the terms mutual fund and index fund refer to. In index funds the funds performance relies only on the movement of the price of the shares included in the fund.

Mutual funds invest exclusively in stocks while index funds do not. Mutual funds are handled by professionals whereas ETFs replicate an underlying securities index. Explain three key differences between index funds and mutual funds.

Index funds tend to turn over assets less frequently than actively managed funds which means fewer capital gains tax eventsanother way index funds can save investors money. Index funds track major market indexes while exchange- traded funds do not. The two terms refer to distinct categories.

Get this must-read guide if you are considering investing in mutual funds. In contrast index funds are closed-ended. Aubree wanted to see if there is a connection between the time a given exam takes place and the.

Index funds seek market-average returns while active mutual funds try to outperform the market. Compare Index Funds vs Mutual Funds Compare - Index Funds Vs Mutual Funds Both index funds and mutual funds are used to diversify the portfolio. The liquidity is provided by the fund itself in the open-ended scheme.

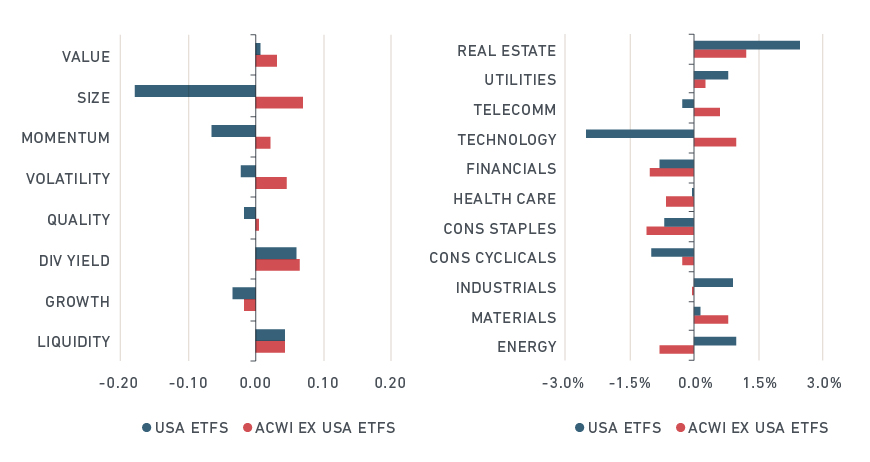

Index-tracking ETFs have lower expenses than index-tracking mutual funds and the actively-managed ETFs out there are cheaper than actively-managed mutual funds. The performance of an actively managed mutual fund will mostly depend on its managers stock or bond picks. Active mutual funds typically have higher fees than index funds.

Ad Get Started Today With Unlimited Free Online Stock ETF Trades. Whereas in the case of mutual funds the performance depends on the investment decisions put forth by the fund managers. An index mutual fund follows the same strategy as the index it is based on.

Mutual fund refers to a. Mutual funds are only priced at the end of the day. All told ETFs and mutual funds may seem to be similar assets but when you dive into the details youll quickly realize that theyre two different beasts.

Mutual-fund managers aim to outperform the benchmark index. A few differences are that ETFs can be bought and sold at any time during market hours like the shares of a stock whereas mutual funds can only be purchased at the end of day after the price has been set. Heres how they do it.

For example if an index fund follows the BSE Index as the replicating index and if it has a 20 weightage in lets say Stock A then the index fund will also invest 20. One the ETF is designed to capture returns of a specific sector or the market as a whole. One of the major differences between an index fund and a mutual fund especially an actively-managed one is their management style - namely whether they are active or passive.

The key difference between the two is that hedge funds chase the big fish investments that are high risk high reward. There are four broad types of mutual funds. 92 of 107 Vanguard stock funds 1.

While mutual funds are managed actively ETFs are managed passively. In an open-ended fund the corpus is variable. New questions in Mathematics.

Mutual funds are actively managed while index funds are passively managed. Index funds often have higher minimum investments than ETFs although some fund providers like Fidelity Investments are dropping their minimum investments on mutual funds. Index funds are ideal for investors who want to invest in equity mutual funds but at the same time dont want to depend on the fund manager.

Overall ETFs are lower cost and more tax-efficient than similar mutual funds. 57 of 66 Vanguard bond funds. 9 of 9 Vanguard money market funds.

Index funds can be. Ad Learn why mutual funds may not be tailored to meet your retirement needs. Equity stocks fixed-income bonds money market funds short-term debt or both stocks and bonds balanced or hybrid funds.

How To Invest In Index Funds A Beginner S Guide Nextadvisor With Time

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-03-16f9ea45d66c4e87ab370f8eb05f00d0.jpg)

The Hidden Differences Between Index Funds

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

Why Index Funds Promote Market Efficiency Msci

/188044056-5bfc391b46e0fb0083c43272.jpg)

5 Things You Need To Know About Index Funds

Index Fund Vs Mutual Fund What S The Difference Smartasset

/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-01-8a899febd3cd4dba861bd83490608347.jpg)

The Hidden Differences Between Index Funds

What Are Mutual Funds Vs Index Funds Vs Etfs Money

How We Became Millionaires With Index Funds Vanguard Schwab Fidelity Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-04-e87a6f8de5e14ab1a4a15f687bdb3ecf.jpg)

The Hidden Differences Between Index Funds

Best Index Funds In India List Of Top Index Mutual Funds 2021

Index Funds Investing 101 A Complete Beginner S Guide

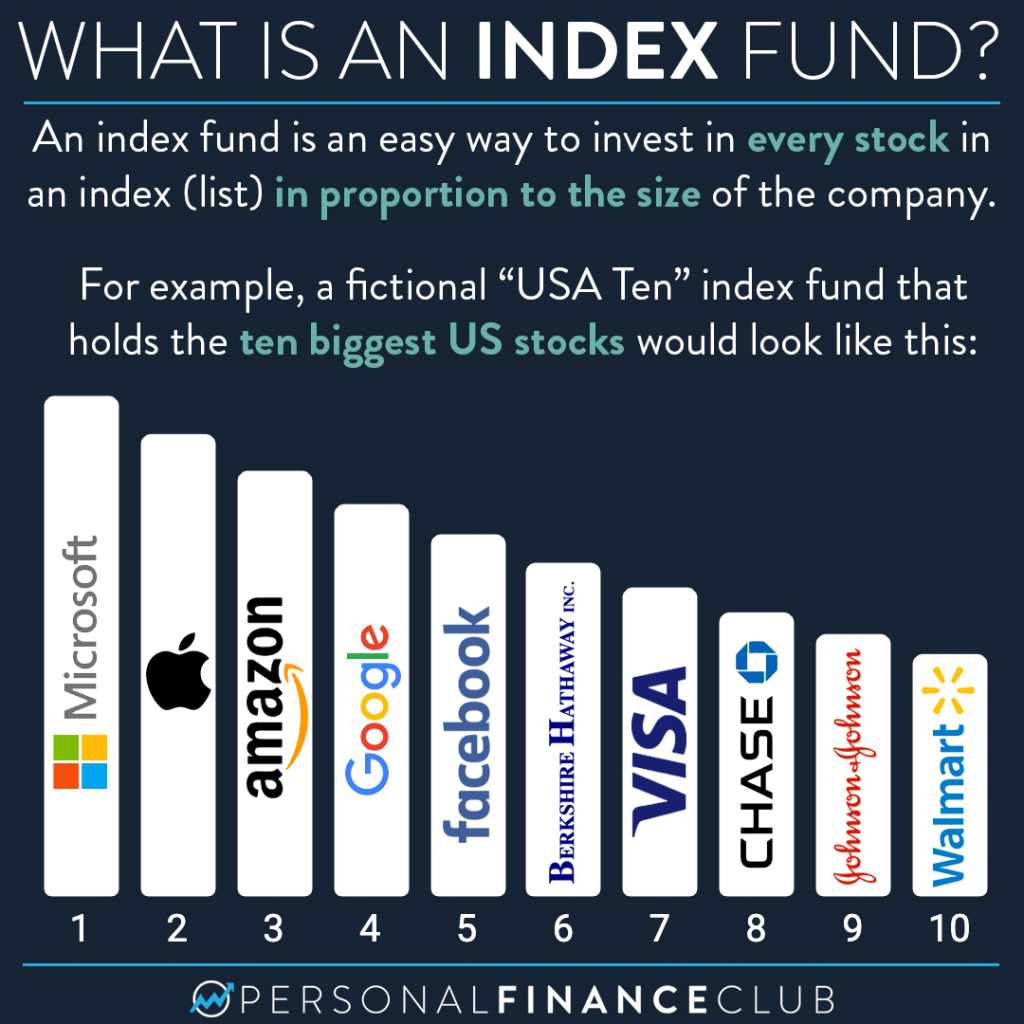

What Is An Index Fund Personal Finance Club

List Of Index Funds In India 2021 Basunivesh

Etfs Vs Index Funds Which Are Better Currency Com

:max_bytes(150000):strip_icc()/dotdash_Final_The_Hidden_Differences_Between_Index_Funds_Mar_2020-02-051df666ccc24f06a8d2d8a09b8f4c24.jpg)

Comments

Post a Comment